Summary

Redeem a portion of BCT/USDC LP from the treasury to extend runway and better utilize capital.

Motivation

During the founding days, KlimaDAO required a robust BCT/USDC pool to maintain USDC->BCT->KLIMA roots into the treasury, as well as to provide the DAO with a steady stream of revenue.

As a reserve currency, KLIMA value and utility is maximized when transactions on the ReFi ecosystem are routed through KLIMA. As proposed in KIP-8 when KLIMA/USDC bonds were first introduced, the DAO looks to develop KLIMA horizontally, becoming a deep reservoir at the crossroads of the on-chain offset market.

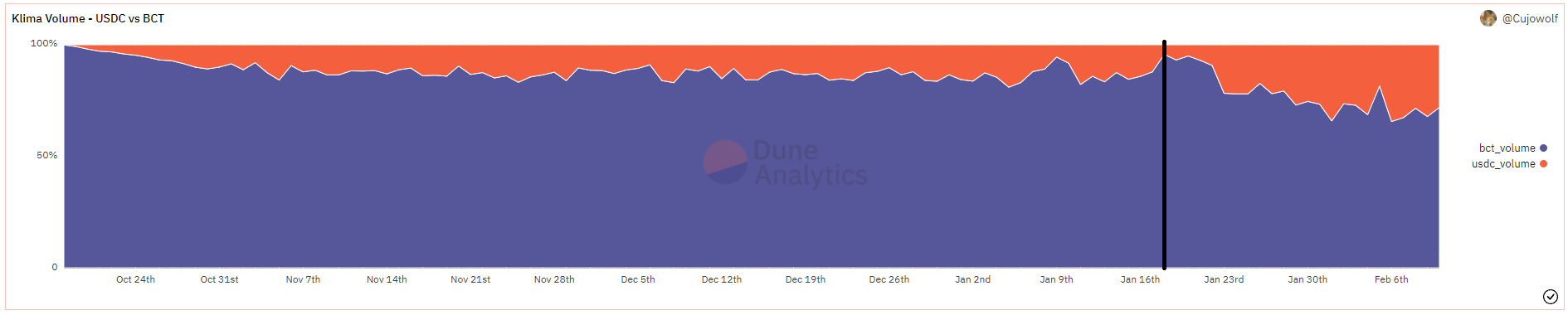

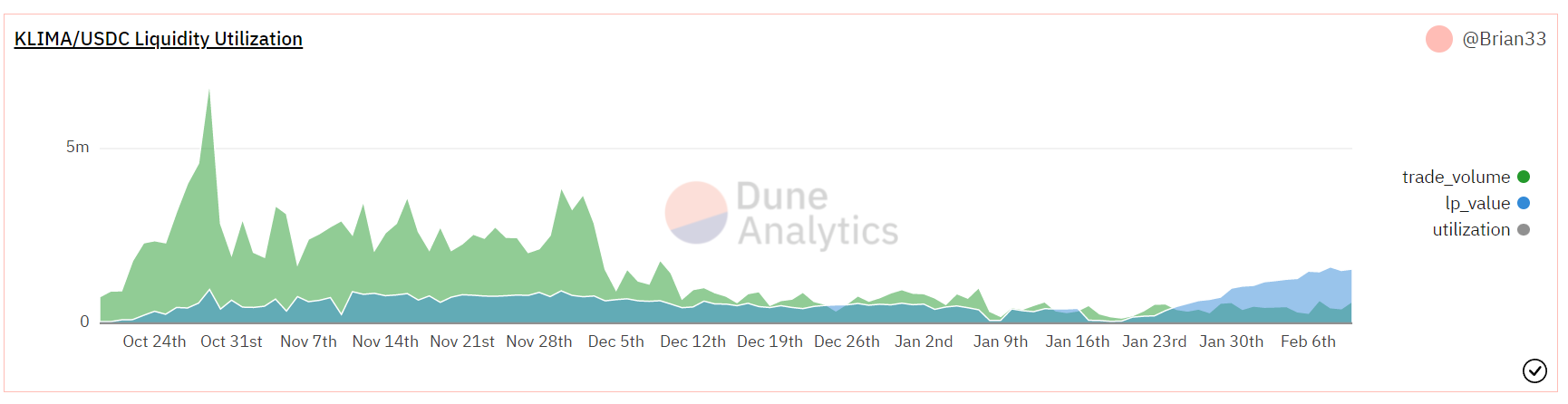

With Klima/USDC, this provides a significant reduction in slippage for users, as it causes the user to not route and experience slippage twice by hopping USDC-BCT-KLIMA. With only a 1.4mm pool (2.3% of total liquidity) , it accounts for 30% of the total Klima volume. As more liquidity is added, we can expect to see more volume facilitated there. Below is the KLIMA/USDC (Orange) vs KLIMA/BCT (Blue) volume. The black line represents the day we added KLIMA/USDC bonds.

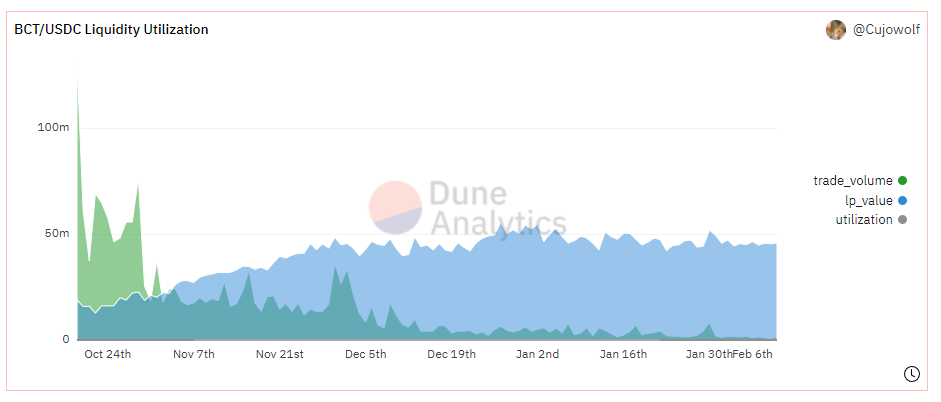

Over the past two months, BCT/USDC pool growth has stagnated, while the volume passing through the pool has reduced. By repurposing a portion of the $45MM currently sitting in the pool, Klima will be able to utilize the underlying assets to better facilitate the market.

Example:

25% of the BCT/USDC represents: 5,525,000 USDC, 1,172,750 BCT

This equates to an additional 10 days of runway at current APYs, with a slippage reduction of 0.008%, using the average trade seen on SushiSwap ($3.6k).

Assuming all of the USDC is utilized for KLIMA/USDC, this increases the ±2% depth from 30k, to around 250k.

Proposal

Allow the policy team to disband 25% of BCT/USDC to utilize in other methods outlined above.

Other:

The USDC can/will be used for multiple things:

Facilitate inverse bonding, where users can buy USDC with KLIMA from the protocol.

Provide a stable base for Klima in times of significant volatility.

OTC trades for carbon assets, facilitated by ReFi protocols such as Toucan, Moss Earth, and GoddessDAO.

Polling Period:

The informal forum poll begins now and will end at Feb 13th 18:00 UTC. Assuming in favor, this vote will go to Snapshot.

Resources:

Sushiswap pool: https://analytics-polygon.sushi.com/pairs/0x1e67124681b402064cd0abe8ed1b5c79d2e02f64

KLIMA/USDC vs KLIMA/BCT volume: https://dune.xyz/queries/391448

BCT/USDC Utilization:

https://dune.xyz/queries/217091/407538

KLIMA/USDC Utilization:

https://dune.xyz/queries/390828