Summary

Adjust reward rate to 0.312%, translating to a 6.2% 5 day ROI, and 8,000% APY, to align with policy priorities and expectations from the community, as well as ensure optimal protocol development.

Empower the Policy team to correct the reward rate when realized APY deviates significantly from the current target APY, ensuring alignment with expectations as laid out in KIP-3 and ongoing reward rate adjustment KIPs.

Motivation

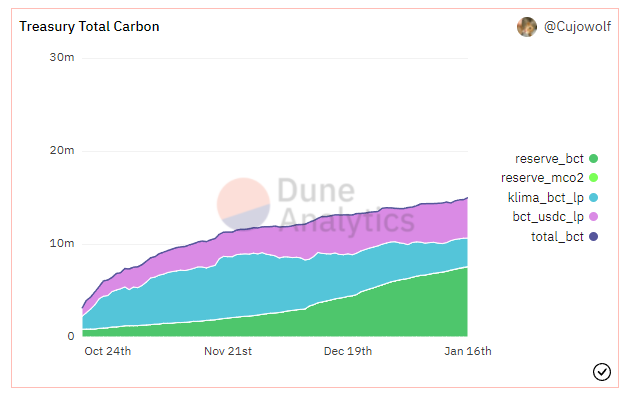

Over the past months, Klima has seen enormous success. The protocol has grown in strength financially (Klima has 83.8% of on-chain BCT market share), technologically (bringing an opaque carbon market on-chain), and expanded its influence (integrations with MCO2, robust deal pipeline).

Integrating MCO2 began diversifying our basket of treasury assets, and serves as a great first step toward directing the exuberance of the retail market for ReFi assets into the Klima treasury. More integrations will create more LPs that the treasury collects fees on, as well as more non-bond revenue from new products and partnerships.

As we move deeper into the Integrations phase of KIP-3, Treasury Total Carbon should be our main focus; not BCT backing of circulating Klima or BCT balance alone.

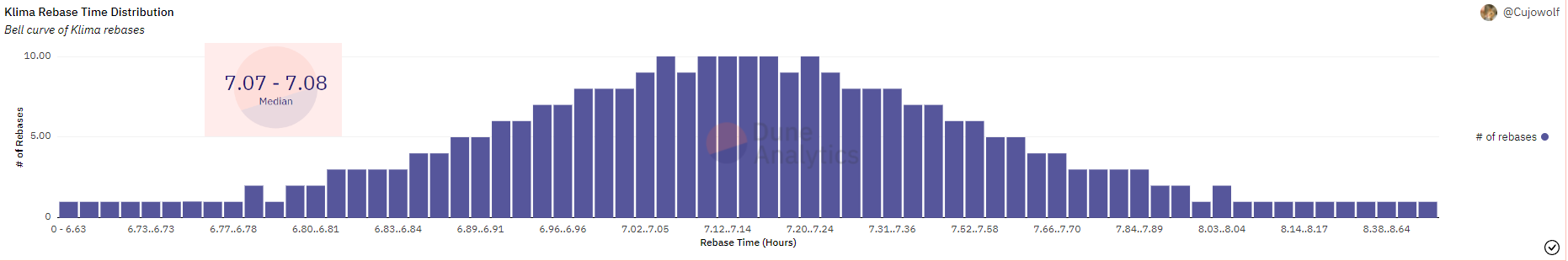

While we progress internally, externally Polygon block times have quickened and trended towards a more frequent rebase. As we saw in KIP-5, we are rebasing (and therefore compounding) at a faster pace than planned. This has led to an effective reward APY that is higher than expected for the formulas, even based on KIP-5’s adjusted 7.25 hours per rebase.

Slight bidirectional variance in rebase times should even out realized rewards over rebases, but congestion events like the recent deployment of Sunflower Farmers have demonstrated that the Polygon chain is susceptible to sharp changes in block time. In preparation of future congestion events, the Policy team will closely monitor Polygon block times for any significant deviations.

Furthermore, the realized APY has also fluctuated significantly in the past few weeks due to the change in % of KLIMA staked. As the percentage of KLIMA supply staked goes down, the projected APY goes up, since the remaining stakers are now sharing a larger portion of the same “pie” of each rebase rewards.

Proposal

In an effort to set proper expansion expectations and remain aligned with the framework approved in KIP-3, the Policy team proposes:

- Adjusting the reward rate from 0.417% to 0.312% to an estimated 6.2% 5 day ROI or ~8000% APY.

This is equivalent to:

- A 0.35% Daily Reduction.

- A 1.87% Weekly Reduction.

- 13 more days to double your sKLIMA balance.

Allow the Policy team to unilaterally (i.e. without passing a KIP) execute minor reward rate corrections,* only when the realized rebase-time-adjusted APY** deviates from the target APY approved in the latest reward rate adjustment KIP for at least 7 days, either:

1) 10% total in either direction.

2) Any amount outside the target APY range for the current KIP-3 stage based on total supply.

*Such corrections must be made in the opposite direction of the justifying deviation to “correct".

** See Dune for a historical chart of realized rebase-time-adjusted APY: https://dune.xyz/queries/233280/437025

This new unilateral ability to correct the reward rate will ensure that the policy team can react promptly when the realized APY diverges from the latest approved target APY, without requiring another KIP.

Polling Period

The informal forum poll begins now and will end at 16:00 UTC on January 21, 2021. Assuming in favor, this vote will go to Snapshot at 16:00 immediately after, concluding at 16:00 UTC on January 26, 2021.

Upon a successful Snapshot vote, the KIP will be implemented and the adjustment of the reward rate will initiate.