- Edited

Summary

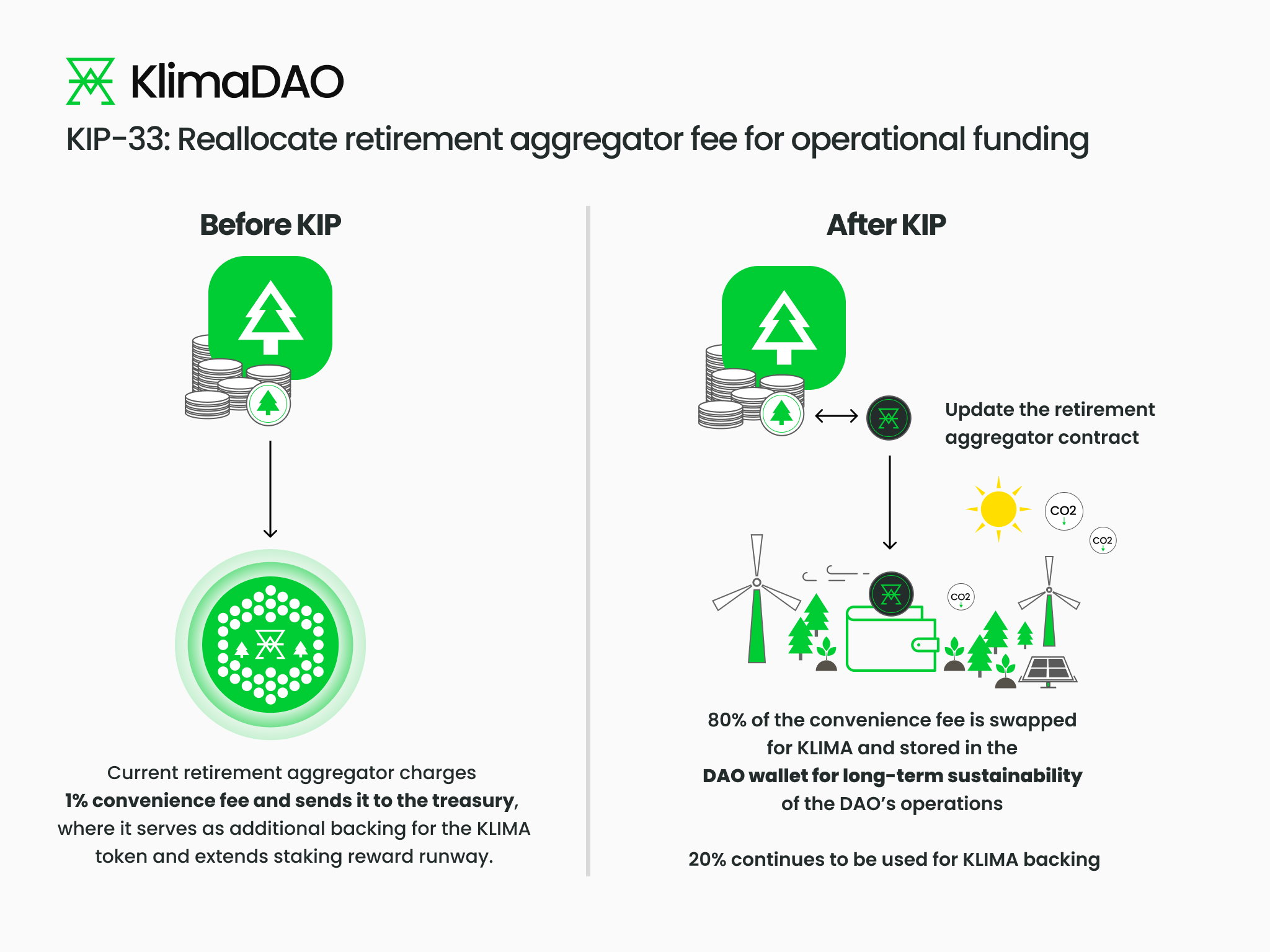

Update the retirement aggregator to allocate 80% of the convenience fee to the DAO wallet, where it will be periodically swapped for KLIMA to fund ongoing operational expenses. The remaining 20% of the fee will continue to contribute additional reserves to the treasury for backing KLIMA tokens.

Motivation

The KlimaDAO retirement aggregator (RA) smart contract includes a 1% convenience fee for carbon credit retirements, charged in terms of the carbon to be retired.

Currently, the RA contract simply sends this convenience fee to the treasury, where it serves as additional backing for the KLIMA token and extends staking reward runway. Per KIP-17, the Policy Team has been delegated the authority to add additional carbon credit tokens into the RA, but this KIP does not address how RA fees should be allocated.

When the RA was first released in February 2022, the treasury was still bonding carbon credits - providing DAO wallet inflows - and staking rewards were high compared to the rate of carbon credits being bridged (prior to the Verra one-way bridging moratorium and implementation of KIP-23). Therefore, the most sensible place to send the RA convenience fee was directly to the treasury, where the carbon credit tokens collected serve as additional backing for the KLIMA token.

Currently, without new tokenization of carbon credits, there is little motivation to restart bonding carbon, and at the current staking reward rate the treasury already has 2000 days of runway (about 5 and a half years). Splitting the fee between the treasury and the DAO wallet will contribute to long-term funding of the DAO's ongoing operational expenses (such as product development, partnerships, and infrastructure) in direct proportion to the throughput of the Retirement Aggregator - one of KlimaDAO’s core products.

Proposal

Update the retirement aggregator contracts such that 80% of the convenience fee is sent to the DAO wallet, where it will periodically be swapped for KLIMA.The remaining 20% continues to serve as KLIMA backing.

The initial implementation of the fee swap would rely on manual execution by the DAO multisig, but in future a smart contract would be deployed to swap any fees collected in the DAO wallet for KLIMA, which would then be automatically invoked periodically by a Chainlink Keeper, Gelato, or similar automation service.

Any changes to this fee split are subject to a subsequent KIP governance vote.

Links

- KIP-17 Delegation of Retirement Aggregator Inclusions

- Retirement aggregator contract address reference

- Retirement aggregator contract guide

Polling Period

The informal forum poll begins now and will end in approximately 6 days on February 6th at 17:00 UTC. Assuming in favor, this vote will go to Snapshot.