Summary

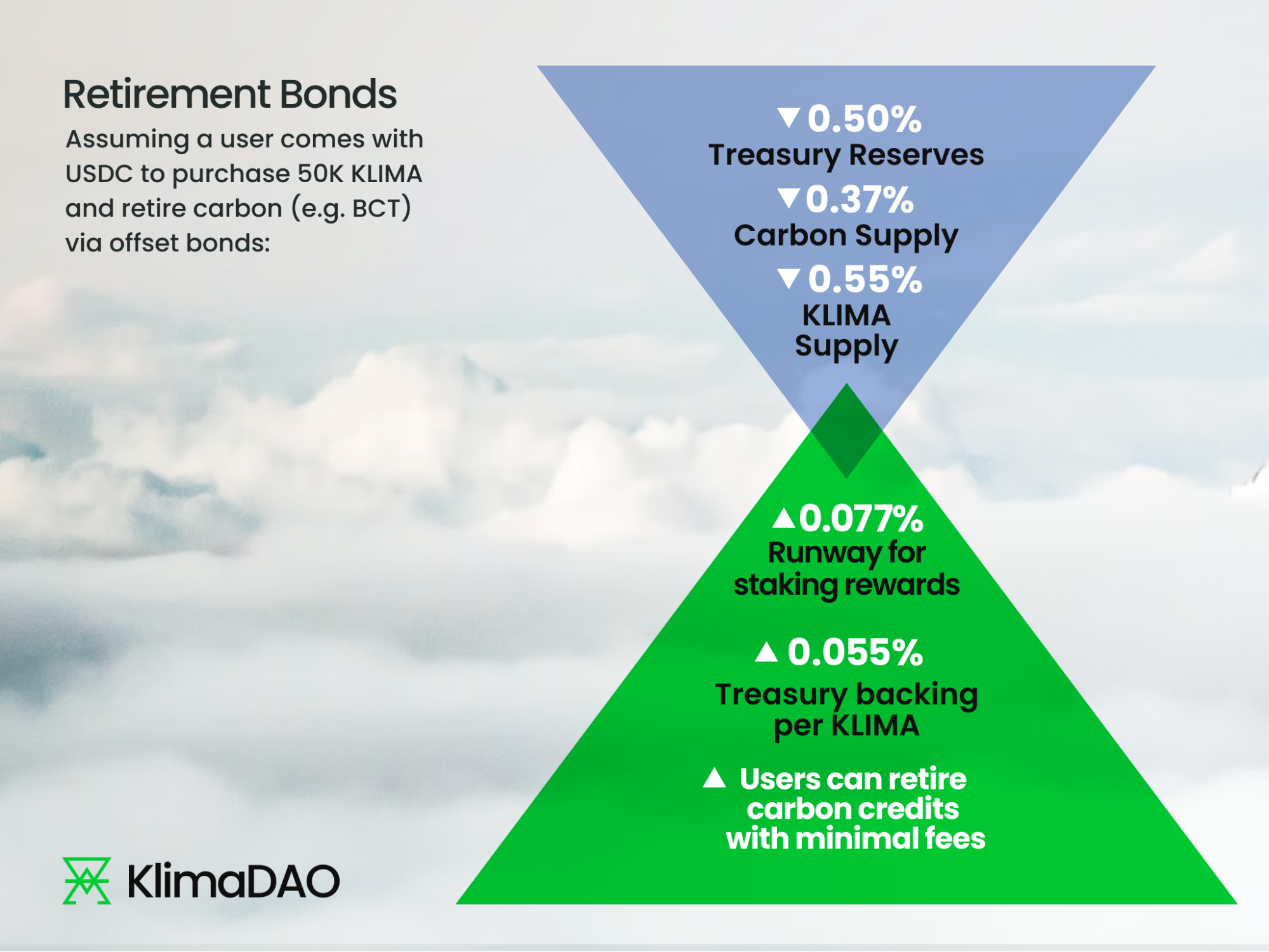

Introduce retirement bonds for using the KLIMA token to retire on-chain carbon. Retirement bonds are a form of inverse bonds where the bonder provides KLIMA tokens in exchange for carbon credits that are immediately retired. These bonds are offered with a maximum slippage amount, acting as an extension of current liquidity pools to support larger retirements.

Motivation

The current tokenomics for the KLIMA token are purely inflationary, with no integrated mechanism for dynamically contracting supply. While inverse bonds are useful in regulating supply and performed as expected during our experiment with USDC, they are not an ideal solution as the USDC sitting within the treasury is a finite resource.

While talking to potential partners looking to retire substantial amounts of digital carbon credits, the current limitations of liquidity pool sizes and structure often result in significant slippage. This dictates the need for a more efficient use of both protocol-owned-liquidity and overall treasury resources to empower organizations to acquire and retire carbon at larger volumes.

Proposal

Introduce Retirement Bonds, where users provide KLIMA to the protocol, which is then burned and the reserve carbon asset immediately retired. This allows the treasury to expand the liquidity needed for targeted pools without diluting existing stakeholders. Only KLIMA tokens are accepted to execute these bonds.

- Pricing: Each bond will be offered at the time-weighted average market rate for the specified carbon credit, with slippage capped at 2% and includes a 30% flat DAO fee.

- Max Bond Amount: The capacity for each Retirement Bond will be configurable for each carbon credit pool.

- Duration: The bonds will be available until all allocated reserve assets are retired or at the end of each month. Each month more reserves can be allocated to Retirement Bond capacity by the Policy Team.

- The KLIMA provided to purchase the carbon would be burned (minus 30% fee sent to the DAO)

Implications

What effect will these bonds have on our key protocol metrics?

Other protocols or projects that want to utilize the rebasing nature of KLIMA for retirement purposes also benefit from this, as their retirements can be directed to the retirement bonds. This reduces the downward pressure on the premium that KLIMA holds on carbon tokens, allowing for better efficiency when bonding more reserves to the treasury.

It is worth noting that creating standard inverse bonds with a carbon reserve asset results in additional pool tokens entering liquidity pools. Retirement bonds behave similarly to that of inverse bonds with the exception of retiring the reserve asset rather than releasing it back into the liquidity pool. Therefore, Retirement bonds naturally increase in effectiveness the closer a reserve asset trades 1:1 with the KLIMA token.

Implementation

- Develop and introduce retirement bonds.

- Allow the Policy team to allocate reserve assets to retirement bonds, not exceeding 5% of total reserves.

- Any reserve token held by the treasury that maintains liquidity paired with KLIMA is eligible for retirement bonds.

Polling Period

The polling process begins now and will end at 12:00 UTC on January 17, 2023. Assuming the forum proposal is approved, it will advance to Snapshot.