Summary

Introduce KLIMA/USDC bonds.

Motivation

Currently, the official KLIMA liquidity ecosystem is a simple 2 pool setup: USDC/BCT, and KLIMA/BCT. For most users, the most liquid route to swap USDC for KLIMA first swaps USDC for BCT, then BCT to KLIMA.

This system was initially made to bootstrap a robust BCT/USDC pool to incentivize users to bridge offsets on-chain via Toucan. We feel that this liquidity pool has been made large enough today, $50m in BCT/USDC. The utilization rate of this pool is consistently under 10%, which signals to the policy team that we have accomplished the goal of facilitating a carbon market for BCT in the short term.

With many new carbon assets coming onto the Polygon network (notably Moss’ MCO2, GoddessDAO’s GNT in short order, and a hint from Toucan about their next pool ), it's time to discuss how the Klima liquidity ecosystem should be developed.

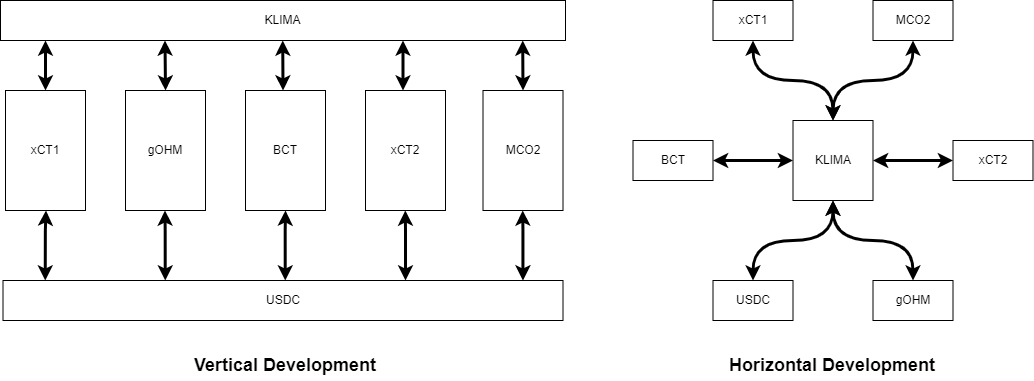

At a high level, as we grow, we can expand liquidity vertically or horizontally. Vertical growth is shown in the diagram on the left, and horizontal growth on the right. By developing KLIMA horizontally, we place KLIMA at the heart of the on-chain carbon economy. This benefits Klima as every trade in the on-chain offset market generates more volume through KLIMA, allowing the ecosystem to grow further by channeling demand and fees into the Klima treasury.

What are the benefits of a KLIMA/USDC pool?

1)Lower fees for the end user:

For most retail users of KLIMA, they will route through the KLIMA/USDC pool, meaning fees are slashed in half for this route. Further, whenever we pair a new carbon asset (e.g., GNT) with KLIMA, a user trying to buy the asset through our pools will have to pay trading fees for the swap from USDC --> BCT --> KLIMA --> GNT. Going forward, they will only have to pay fees for the swaps from USDC --> KLIMA --> GNT. This allows new carbon assets to plug into KLIMA's existing liquidity, while reducing the trading cost for users.

2)Capital Efficiency:

When you create liquidity for a carbon/USDC pair, the liquidity is fragmented from each pair. By having one single pair, you gain much greater depth, which benefits all users. Say that we incentivize 1 single 200m KLIMA/USDC vs. 4 separate 50m carbon/USDC pairs. The 2% depth (the amount needed to move the price 2%) would increase from 250k, to 1m.

Every future carbon asset that decides to incentivize a carbon/KLIMA pair, will have immediate access to the KLIMA/USDC liquidity pool on day one.

3)Better alignment of demand.

Currently, BCT buying pressure comes from 3 things:

i) Users buying KLIMA, which buys BCT because of the two pool system.

ii) Users buying BCT.

iii) KlimaDAO’s BCT bonds.

Ideally, point ii) and iii) would represent the majority of the demand of BCT, but because of the 2 pool system, point i) siphons pressure from KLIMA to BCT. While this isn’t a bad thing in itself, more of this should flow to the KLIMA token instead. This is accomplished by growing the KLIMA/USDC pool.

By incentivizing liquidity for the KLIMA/USDC pair, it will lead towards a much healthier, more robust Klima ecosystem, that all current and future participants will benefit from.

Other:

As the Polygon ecosystem grows, other stablecoins will be evaluated. In the future we may migrate to a different stablecoin.

The BCT/USDC capacity will be adjusted/removed as necessary, and can be reopened if demand is sufficient.

Polling Period:

The polling process begins now and will end at 1/15/2022 23:00 UTC. If voted in favor, a Snapshot vote will be put up shortly after, which will run for 2 days.